Questions about the Beneficial Ownership Information Report?

We've got answers!

Businesses are now required to file a BOI report to FinCEN to help prevent financial crimes.

Our team can file your BOI for only $49

Beneficial Ownership Information Reporting Overview

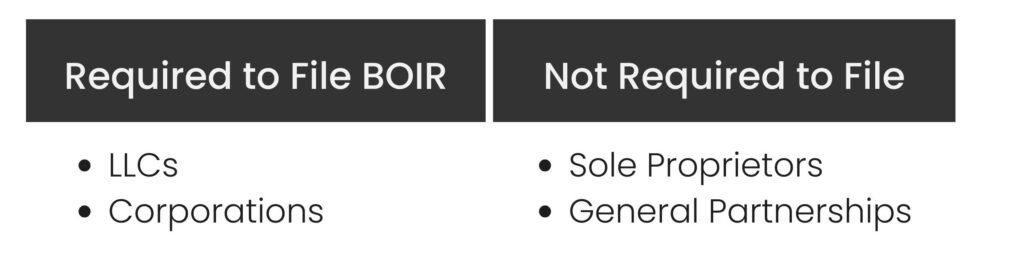

Who Needs to File?

If you own a business that you have registered with the state or federal government, you will need to fill out a Beneficial Owner Information Report. This includes LLCs and corporations.

Sole proprietors and general partnerships that have not registered their entity do not need to file.

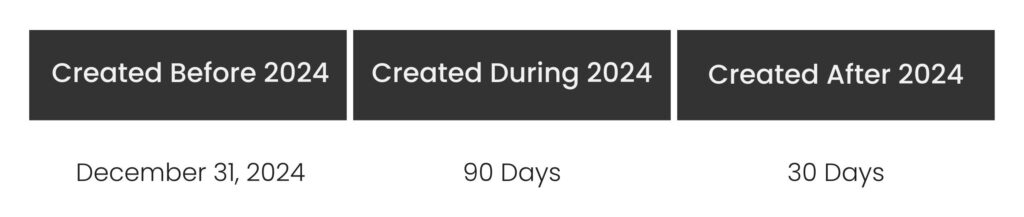

When Do I Need to File?

If you created or registered your business before 2024, you need to file a BOI report by the end of the year. If you created or registered your business in 2024, you need to fil within 90 days. For businesses created in 2025 and beyond, you have 30 days to complete a BOI Report.

How Do I File?

To file yourself, gather all the necessary information and go to boiefiling.fincen.gov to complete and file the report. Or, fill out the form below and our team will complete it for you. We specialize in helping small businesses stay compliant!

FILL OUT THE FORM BELOW TO GET STARTED!

FAQs

Beneficial Ownership Information Reporting refers to the process of disclosing and documenting the individuals who ultimately own or control a legal entity, such as a company or trust. The concept is crucial for promoting transparency and preventing illicit financial activities, such as money laundering, tax evasion, corruption, human and drug trafficking, as well as fraudulent actions against employees, customers, and other businesses.

The Beneficial Ownership Information Reporting Rule entails a new obligation established by the Corporate Transparency Act and overseen by the Financial Crimes Enforcement Network (FinCEN), operating under the United States Department of the Treasury.

The reporting of beneficial ownership information aligns with the persistent endeavors of the U.S. government to discourage corporations from concealing their actions or deriving benefit from actions that inflict harm on others.

By providing this information through the beneficial ownership information report, companies aid authorities in maintaining the integrity of financial systems and preventing the misuse of corporate entities for illegal purposes.

A beneficial owner of a company is someone who exercises substantial control over the company, or owns or controls at least 25 percent of the company’s interests. This includes:

- Senior officers, such as presidents, CFOs, CEOs, COOs

- Important company decision makers

- Someone who has authority to appoint or remove officers or directors

- Someone who owns or controls at least 25 percent of the company’s ownership, equity, voting rights, or stock

The beneficial ownership rule covers the majority of businesses operating within the United States, excluding domestic sole proprietorships or general partnerships. However, other specific exemptions have been outlined. These exemptions encompass certain categories such as banks, credit unions, investment companies, insurance companies, and regulated public utilities.

In general, for business entities established before January 1, 2024, the deadline for filing is December 31, 2024. Those formed on or after January 1, 2024, are granted a 90-day window post-formation to file. Furthermore, entities that modify their formation documents on or after January 1, 2024, are required to submit a new report within 30 days.

Adhering to this requirement is crucial to avoid potential criminal and civil penalties for non-compliance. Penalties may include imprisonment for up to two years, a fine reaching $10,000, and/or a daily fine of up to $500.

The goal of Vyde has always been to help small business owners achieve their own business success. We strive to provide industry-leading accounting services to help you stay compliant and save money, time, and stress.

Our expert team can help you navigate BOI reporting requirements. We ensure accuracy, compliance, and timely submissions, helping you navigate the requirements effortlessly.

Yes you can! Business owners can file the report online at boiefiling.fincen.gov/fileboir. For more details about how to file a BOI Report yourself, explore our guide.

Business owners may encounter difficulties in understanding the criteria for beneficial ownership and accurately documenting this information. Managing filing deadlines, keeping up with regulatory changes, and avoiding errors in submissions can also pose significant obstacles. Our team can help you file your BOI Report, stay compliant, and avoid penalties.

No. You do not need to file another BOI report unless information about your company or its beneficial owners changes. If that happens, you can file an update with FinCen or reach out to our team and we can make the update for you!