After a client begins using your products or services, it’s easy to focus on gaining even more clients, rather than focusing on the ones you already have. Thanksgiving is the perfect time to show your existing clients how grateful you are for their loyalty, and expressing that gratitude doesn’t have to be expensive.

Here are 12 quick, easy, and inexpensive ways to show gratitude for your clients this November:

- Go old school with a handwritten note. The importance of this simple gesture cannot be overstated. In fact, in an increasingly fast-paced, technology-driven world, handwritten notes are becoming a lost art. Have trouble sharing your feelings? Try this guide.

- Send them a treat. Cookie tins are always a hit, and can fit into almost any budget. Other popular treats are fudge, meat and cheese trays, fruit baskets, gourmet candy, and freshly baked bread. Have them delivered to your client’s office before they’re bombarded with goodies in December.

- Share your knowledge. Communicate with clients and share your expertise. Whether it’s an email newsletter, helpful hint on social media or printable checklist, customers love useful information about the service or product they’re purchasing.

- Remember special occasions. If you have inside information about a client’s business anniversary or special occasion for them, send them a quick email or message congratulating them or wishing them well.

- Offer them 15 minutes of fame. Spotlight a client in your newsletter or social media page. Offer some free publicity by linking to their website and giving a quick shout out about how great they are.

- Reward them with a coupon or gift. Get in the gift-giving spirit by offering an awesome discount at your store or business. Design the coupon around a theme of gratitude for that extra holiday touch.

- Host an event. This idea may be a little more costly, but if the money is in the budget, host an event at your business. It doesn’t have to be anything extravagant–order a sandwich tray and some punch and get the party started! Send out invitations asking your clients to stop by for lunch and a quick visit.

- Give a great read. Get your Christmas client appreciation done early by choosing a great book that is inspirational and thought-provoking for your clients. Be sure to include a handwritten note or bookmark in the cover. You may even choose a few of your favorites and put some thought into which book to send to which client.

- Start a loyalty program. If you haven’t already, start a program that gets customers excited about continuing their business with you. Offer special discounts, extended shopping hours, or extra perks during the holiday season for loyal clients only.

- Discount their bill, just because. Clients will be surprised and appreciate the extra savings during a financially stressful time of year. Slash their monthly bill by 50% one month or offer 25% off at the register, just because you appreciate their business.

- Make them laugh. If you’ve got a creative mind on staff, have them step up and create a funny and personalized client gift or message. One idea: Photoshop your client into a famous movie poster, rename it something clever and email the picture with your note of “Thanks for your business!”

- Most importantly, do all that you can to improve their customer experience. Nothing shows clients how much you care quite like asking for honest feedback, responding personally and thoughtfully to it, and then making changes to better serve them. Be open and willing to adapt. Your clients are sure to appreciate just knowing their voice has been heard.

FAQs:

1. Why is it important to show gratitude to existing clients?

Expressing gratitude fosters loyalty and strengthens relationships, leading to long-term client satisfaction and retention.

2. What are some inexpensive ways to show appreciation to clients during Thanksgiving?

Options include handwritten notes, sending treats, sharing knowledge through newsletters or social media, acknowledging special occasions, and offering discounts or coupons.

3. How can I personalize client appreciation gestures?

Tailor gestures to individual clients by acknowledging their business anniversaries, spotlighting them in newsletters or social media, or sending thoughtful gifts such as books with handwritten notes.

4. Is hosting an event for clients feasible for small businesses?

Hosting an event doesn’t have to be extravagant. Even simple gatherings at your business with refreshments can provide a personal touch and foster client engagement.

5. Why is it important to prioritize improving the customer experience?

Actively seeking and implementing client feedback demonstrates a commitment to their satisfaction. Adapting based on their input enhances trust and loyalty, ultimately benefiting both parties.

If you read our

If you read our

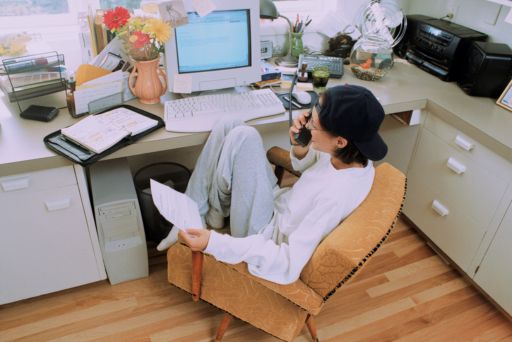

If you own a small business, you undoubtedly work from home, at least on occasion. If you’re like many small business owners in today’s world, you might even work exclusively from home. Whichever category you fall under, claiming a “home office” on your taxes can be tricky. Here’s a quick step-by-step guide to make sure you’re in line with IRS standards when it comes to your home office.

If you own a small business, you undoubtedly work from home, at least on occasion. If you’re like many small business owners in today’s world, you might even work exclusively from home. Whichever category you fall under, claiming a “home office” on your taxes can be tricky. Here’s a quick step-by-step guide to make sure you’re in line with IRS standards when it comes to your home office.