It happens to everyone. Small businesses, entrepreneurs, and even giant corporations have products that fail, launches that never happen and spreadsheets that show tanking finances and little to no cash flows. It’s important to make smart choices but a savvy businessperson knows that even the best decision making can still sometimes lead to operating at a loss.

The important thing is to know how to come back from it.

So what do you do if your business is operating at a loss? We’ll, we’ve got 3 simple answers – but first lets talk about what operating at a loss really means.

How do I know if my business really isn’t making money?

Simply put, your business is operating at a loss if you’re spending more money than your business is bringing in. Most businesses, especially small businesses fall into this category at the beginning and many do so during periods of growth. Operating at a loss for a short period of time, really isn’t a problem if you’ve got enough cash flow to cover your expenses until your income starts to grow.

In fact, you’ve probably heard experts or even other entrepreneurs talk about cash flow problems – which is just a business-like way of saying they’re short on cash or that their money is tied up in product, office space, and equipment. The real issue comes when you operate at a loss for too long – but how is a small business owner or entrepreneur supposed to know when that is?

Well, if you projected start-up costs as you started out there shouldn’t have been many surprises on what your business was going to cost. If you did project start-up costs, you hopefully also put together a cost analysis that includes the general cost of rolling out your product/service or starting your business. In that same line of thinking you should be looking to estimate or project the number of sales you’ll be making. Where those 2 lines cross will be your break even point (where the income from additional sales is profit as opposed to covering the costs you incurred while setting up your business).

Understanding the technical side of things is good, but focusing on how you can bring in more cash flow is the best thing you can do.

So what do you do if your business is operating at a loss? We’ve got 3 simple answers.

No. 1 – Reduce Your Expenses

All businesses, even those that are strictly service-based or online, have some business expenses. One way to help free up some cash is to go back through your operating costs and see if there are places you can eliminate the expense or at least cut back significantly. Keep in mind that while cutting costs is an effective way to loosen up your cash flow, you won’t want to cut back so far that it’s difficult to do business or handicaps your abilities to provide quality service and marketing of your product.

No. 2 – Increase Your Sales

Before we talked about that line on your start-up projects that estimated the number of sales (and the associated revenue) you thought you’d bring in. When you’re tight on funds, looking to increase your sales is always a surefire way to increase your bottom line. Taking a hard look at your projected sales numbers will help you decide a couple of things:

- whether or not you can do a promotion to drum up sales an still bring in more cash

- if you’re hitting your sales goals and if those goals need to be raised to insure a steady cash flow

- if you need to adjust the price of your product or service

If you’ve got employees, it might be the right time to introduce a little friendly competition and award the winner with the most sales a special prize – which may even be the bragging rights of having the top numbers or a coveted parking space.

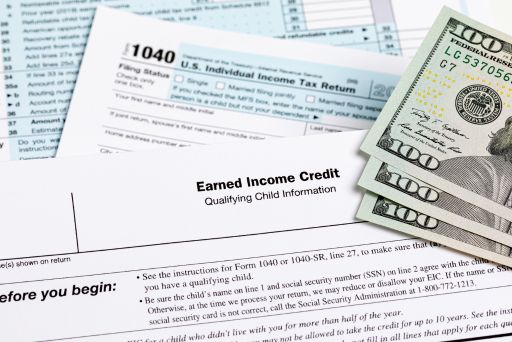

No. 3 – Seek Advice from an Expert

We live in a world where the DIY approach is becoming more and more common. But there are times when seeking expert advice will make things simpler in addition to making sure they’re the best long term strategy. When it comes to operating a business at a loss, seeking expert advice from your accountant will ensure you’ve got all the financial answers you need. In addition, they’ll be able to help you turn your finances around so you’ve got more cash flow and even help you figure out what deductions you can take come tax time.

Remember, it’s normal to have cash flows be slow or even non-existent at first. Just keep up the good work and make sure you’ve got a handle on your sales numbers, your operating costs, and how they effect your bottomline.

Have more questions about operating your business on a loss? Send us a note – our experts are more than willing to answer your questions!

FAQs for Operating at a Loss in Business

1. How do I determine if my business is operating at a loss? Your business operates at a loss when expenditures exceed income. It’s common initially or during growth phases, manageable with sufficient cash flow until income increases.

2. How can I gauge when operating at a loss becomes problematic for my business? Monitor your start-up costs, project expenses, and sales estimates. Recognize your break-even point where additional sales generate profit, not just cover initial costs.

3. What strategies can help a business dealing with a loss? Reduce Expenses: Assess and cut non-essential expenses without hindering operations or service quality. Increase Sales: Revisit sales projections, consider promotions, adjust prices, and foster healthy competition among employees to boost sales. Seek Expert Advice: Consult with an accountant or financial expert to strategize, manage cash flow, and identify potential tax deductions.

4. How vital is it to focus on increasing cash flow during a loss? Increasing cash flow is paramount. Balancing operating costs and sales figures aids in ensuring financial stability and sustained business growth.

5. What should I do if my business continues to experience slow cash flow? Persistently manage sales figures, operating costs, and seek expert guidance to optimize finances. Maintaining vigilance helps weather initial challenges in business operations.

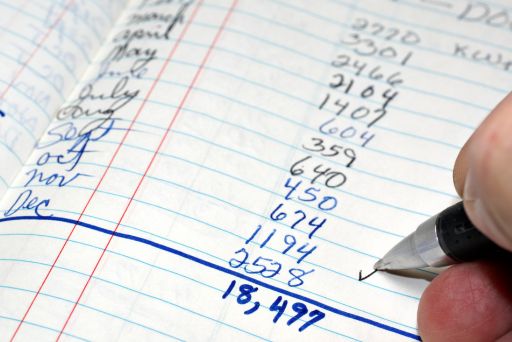

An organized bookkeeping system is arguably the most critical component of monetizing a blog business. It doesn’t matter if you’re making boocoo bucks on your blog if you aren’t tracking money coming in and money going out. Here’s how we suggest you manage your time when you’re taking care of your own

An organized bookkeeping system is arguably the most critical component of monetizing a blog business. It doesn’t matter if you’re making boocoo bucks on your blog if you aren’t tracking money coming in and money going out. Here’s how we suggest you manage your time when you’re taking care of your own