Marketing is an important aspect of any business, but it’s often overlooked because it can be costly. If you’re trying to save money by taking on the marketing for your business by yourself, then these 5 marketing terms will p you get started.

Lead magnet

Lead magnets are most commonly used to increase subscribers to your email lists. A lead magnet is a resource given to subscribers in exchange for signing up for your email.

Lead magnets should be irresistible. They should solve a problem. The most successful lead magnets are short and sweet so that the subscriber can quickly solve their problem. For example, a 10 page guide on how to generate more business from your Facebook page is more effective than a 10-part video series, emailed out once a week. People want to be able to get the information they need instantly rather than wait around for weeks to get all the information.

Examples of lead magnets include:

- Cheat Sheets

- Reports

- Quizes

- Resource Library

- Training Videos

- Free Trials of Programs

- Free Shipping

- Coupon Codes

Your lead magnet should be targeted towards your audience. How can you solve a problem in their lives? Answering this one question can help you create a solid and successful lead magnet.

Call to Action

A call to action (CTA) is how you convert readers or viewers into customers. A CTA encourages people to take action, whether that is signing up for your newsletter, calling your offices or even repinning your posts on Pinterest. It’s a way to encourage people to interact with your business.

Effective CTAs are simple but powerful. The CTA should tell your reader what they’re getting out of interacting with your company; (this is where you can push your lead magnet) and how to take action. A CTA can be as simple as: “Get Started” or “Sign Up Now.”

A call to action is more than just text. Use design elements to catch the eye of your readers and lead them towards your CTA. Color is a great way to do this. Try making your CTA color the same as your logo so that readers can associate your business and the solution to their problem.

Search Engine Optimization

Search Engine Optimization (SEO), is a critical part of marketing. It’s more than just a marketing term to understand, it’s almost a language within itself. Search Engine Optimization is used to improve your website’s rankings on search engines, which helps people find your site.

SEO has changed a lot in the last few years. There are still key aspects that search engines look for such as:

- Title Tags

- Keywords

- Image Tags

- Internal Link Structure

- Inbound Links

However, SEO is much more than keywords. Search engines are looking for quality content that is helpful to readers. If you stuff your website full of keywords without any substance it can actually hurt your website.

Site structure and design are also important aspects of SEO. A quality website is going to rank higher, so it’s good to invest in making your website well designed and well optimized.

Churn Rate

Churn rate is the percentage of customers lost over a period of time. It can also be used to calculate the value of each customer lost. Knowing your churn rate is important so that you understand how much each new customer is costing you. You need to be able to know if customers are sticking around long enough to cover the acquisition costs.

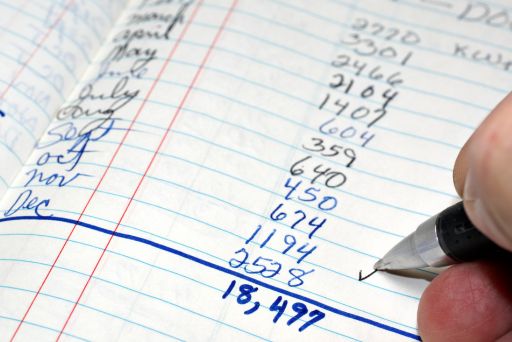

Calculating churn rate is very easy. Start by taking the number of customers lost during a certain time period and divide it by the overall number you had when the time period started. The result is your churn rate. For example if you started your quarter with 600 email subscribers and you lost 60 of them over the quarter, your churn rate equation would look like this: 60 / 600 = .10 or 10%.

You can do this for any time period: a month, quarter, year etc. You just don’t want to include any new customers you acquired during the time frame when you’re calculating the churn rate.

Editorial Calendar

An editorial calendar is important to help you stay on track with your marketing goals. Editorial calendars can be used to create content, plan campaigns, reach out to your target market and more.

It’s important to be posting new blog content on a regular basis (this helps with your SEO!) You’ll also want to be posting consistently to social media to increase your reach. An editorial calendar can help you plan out all of these so that your social media presence goes along with your website. An editorial calendar can also help you keep track of things that are out of the ordinary, but need to be dealt with, like posting about holidays.

Overall an editorial calendar is an essential organizational tool for businesses.

Hopefully, these marketing terms will do more than just increase your vocabulary. If you learn how to implement them in your business it can help your marketing efforts increase.

Frequently Asked Questions

1. What is a lead magnet and how can it benefit my business?

A lead magnet is a valuable resource offered to potential customers in exchange for their contact information, typically their email address. Lead magnets are designed to attract and engage your target audience by solving a specific problem they face. Examples include cheat sheets, reports, quizzes, and free trials. An effective lead magnet can increase your email subscribers and generate leads, ultimately helping to grow your business.

2. How can I create an effective call to action (CTA)?

An effective call to action (CTA) should be simple, direct, and compelling. It encourages your audience to take a specific action, such as signing up for a newsletter or purchasing a product. To create a powerful CTA, clearly communicate the benefit of taking action, use strong action verbs, and incorporate design elements like contrasting colors to make the CTA stand out. For example, “Get Started” or “Sign Up Now” are concise and actionable CTAs that guide users towards the desired action.

3. Why is Search Engine Optimization (SEO) important for my website?

Search Engine Optimization (SEO) is crucial because it improves your website’s visibility on search engines, making it easier for potential customers to find you. Key aspects of SEO include optimizing title tags, keywords, image tags, and internal link structure. Beyond keywords, SEO also involves creating high-quality, relevant content and ensuring a well-designed website. Effective SEO can lead to higher search rankings, increased website traffic, and more business opportunities.

4. What is churn rate and why is it important to track?

Churn rate is the percentage of customers lost over a specific period. It’s essential to track because it helps you understand customer retention and the effectiveness of your marketing efforts. To calculate churn rate, divide the number of customers lost during a period by the total number of customers at the start of that period. For example, if you start with 600 customers and lose 60, your churn rate is 10% (60/600). Monitoring churn rate helps you evaluate customer loyalty and the cost-effectiveness of your customer acquisition strategies.

5. How can an editorial calendar help with my marketing efforts?

An editorial calendar is a strategic tool that helps you plan and organize your content creation and marketing activities. It ensures you post consistently on your blog and social media, which is crucial for maintaining audience engagement and improving SEO. An editorial calendar helps you align your marketing efforts with your business goals, track important dates like holidays, and coordinate campaigns effectively. By staying organized and proactive, you can enhance your marketing efficiency and effectiveness.