Enjoy a Stress-Free Tax Season with Vyde

Here’s our secret recipe for a seamless tax season, including tax deadlines, tips for customers, and more!

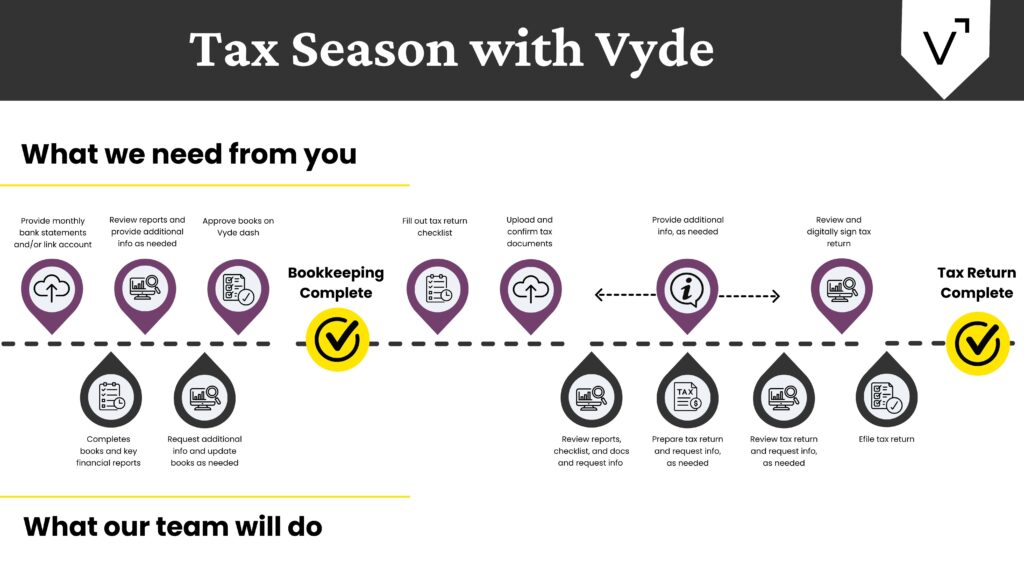

Our process is simple and thorough

You provide bookkeeping info and approve books.

Bookkeeping is the first step to preparing your tax return and the key to maximizing your tax savings.

For members on our Starter and Plus plans, our team will do the bookkeeping for you! Please provide your business bank statements or link your business bank account and promptly respond to emails from your bookkeeper to help us maximize your deductions and ensure accuracy. We also ask that you approve your books on your Vyde dashboard before our team starts working on your taxes.

For Vyde members on our Tax Only plan, we will need you to provide your income statement and balance sheet to our team.

Remember, bookkeeping can be the most time-intensive part of the process, so staying on top of your books throughout the year will speed up the tax process.

You complete your tax return checklist.

Please fill out your tax checklist to provide us with the information we need to accurately file your taxes. This should only take 10-15 minutes.

Your tax checklist also includes essential information to allow our team to file an extension for your business. Please provide this information as soon as possible so we can keep your taxes on track and help you avoid penalties.

You upload and confirm your tax docs.

Please upload any tax-related documents to your Vyde dashboard. (Don’t know which documents to upload? Check this list.)

Once you have finished uploading all your tax docs, please confirm you have uploaded everything on your dashboard so we can get started on your taxes.

We'll ask questions along the way.

At any point in the process, if we have questions or think we might be missing something, we will send an email to you and post and update on your Vyde dashboard.

Be sure to keep an eye out for messages from our team and respond promptly so we can keep your books and taxes on track!

We prepare and review your taxes.

Once your books are complete, you’ve completed your tax checklist, and you have confirmed you have uploaded all your tax documents, an accountant will prepare your taxes. Then, your dedicated tax accountant will review your tax return to ensure everything is accurate and we save you the most possible.

You sign; we finish and file your tax return!

Last of all, we send your taxes to you to review and sign. If any corrections are needed, our team will work with you to make those updates. Once everything looks good to you, we’ll file your taxes for you!

During tax season, you can see the progress of your taxes by logging in to your Vyde dashboard!

Download Your Tax Season Roadmap

Want a step-by-step overview of our tax process to help you stay on track this tax season? Download our Tax Season Roadmap! Select your plan to access a detailed guide designed to make your life easier.

Tax Deadlines

To guarantee we can finish your tax return by the IRS deadline, Vyde sets our own guidelines for our clients. These dates provide us with extra time to ensure accuracy, request missing information, and thoroughly review your taxes.

Vyde Deadlines

- December 31 - Opt in to Vyde's 1099 services and upload W9s

- January 15 - Approve 1099 details

- January 31 - Provide any missing 2024 bookkeeping information to Vyde (bank statements, unclassified transactions, etc.)

- February 15 - Complete your tax checklist, approve books, and upload all business tax documents (see examples)

- March 15 - Upload and confirm all personal tax documents have been provided to Vyde (see examples)

- August 15 - Upload all business tax documents for the extended deadline (partnerships & S Corps)

- September 15 - Upload and confirm all personal tax documents have been provided to Vyde for the extended deadline

IRS Tax Deadlines

- March 17 - Business tax deadline for partnerships, multi-member LLCs, and S-corporations filing form 1120-S

- April 15 - Personal tax deadline and business tax deadline for all other businesses

- September 15 - Extended partnership, multi-member LLC, and S-corporation tax return deadline

- October 15 - Extended personal tax return deadline and extended business tax deadline for all other businesses

What happens if I miss a deadline?

Life happens. We understand. Provide us with any missing information as soon as possible.

If you miss Vyde’s deadlines, we cannot guarantee we will file your taxes by the tax deadline. But don’t worry. We will extend your taxes to help you avoid penalties and make sure we have enough time to do things right.

But be sure to fill out your tax checklist! That will provide us with the information we need to file an extension. Without that information, we cannot file an extension to help you avoid late penalties.

How long will my taxes take?

Once your books are complete, you’ve approved them, you’ve filled out your tax checklist, and you’ve uploaded any tax documents, we commit to finishing your taxes within two weeks. Log in to your Vyde dashboard during tax season to see your estimated tax delivery date.

Why two weeks? We want to make sure you and we have time to review your taxes and collect any missing information. We’ll work hard to finish your taxes quickly without compromising accuracy!

Need your taxes sooner?

Reach out to your dedicated team using the contact information on your Vyde dashboard. We’ll work with you to meet your needs. Depending on how quickly you need your taxes, an expedite fee may apply.

We are here for you!

Our team is here to make this a great tax season. We’re happy to answer your questions and love to meet with you.

As a reminder, this is our busy season, so if you would like to meet with your guide or tax accountant, be sure to schedule your appointments early. You can reach out to your dedicated team directly using the contact information provided on your Vyde dashboard.

Of course, you can always reach our team at:

866-575-9100

Phone

support@vyde.io

1078 South 250 East, Provo, Utah 84606

Address

Tips for Tax Season Success

FAQ

Our team provides updates on your books and taxes on the home page of your Vyde dashboard. From here, you can view the status of your tax return, what information we need from you, as well as estimated delivery dates. You can also reach out to your dedicated guide at any time to check on the status of your books and taxes, and our team will proactively reach out if there is more information we need from you.

Bookkeeping is critical to making sure we capture all your deductions so we can save you the most possible. In addition, it ensures your taxes are accurate. Our thorough process is what has helped us achieve the goal of $0 IRS audit fees paid by our clients.

We believe in being thorough and accurate. Other accounting firms may push out tax returns faster, but they don’t take time to complete your bookkeeping and review your taxes to ensure no deductions or mistakes are missed. Our tax process has helped us ensure no Vyde client has had to pay IRS audit fees, and none have been audited in 7 years and counting!

Yes! We would love to help you with that. You can find more information at vyde.io/1099-services/

The first step in your tax return process is completing your bookkeeping. Without that, we cannot start to prepare an accurate tax return. Once our team has all of your bookkeeping information, providing us with the rest of your tax information is as easy as 1, 2, and 3:

Complete your tax return checklist in the Vyde dashboard

Upload any relevant tax documents in the “My Files” section of your Vyde dashboard (see some examples here) and confirm all relevant documents have been uploaded

Upload your prior year tax return in the “My Files” section of your Vyde dashboard if this is the first year we are preparing your taxes

Overall, extending your tax return can be very beneficial for your business. It can give you more time to make sure your taxes are accurate and to catch deductions that can lower your tax bill. Extending your tax return does not result in penalties or increased risk of an audit.

However, it’s important to note that even though the tax return itself is extended, your tax payment is not. Be sure to still make an estimated tax payment on time to avoid late penalties. You can learn more about how extensions can impact your business at vyde.io/extensions.